How to Check free Credit Score | How to Check Free CIBIL Score | How to free credit score check

What is Credit Score

A person’s creditworthiness is represented numerically in India by their credit score. Credit bureaus create it using the person’s financial behavior and credit history as input. Lenders take into account a person’s credit score when assessing their application for credit, whether it be for a credit card or loan.

TransUnion CIBIL (Credit Information Bureau India Limited), Equifax, Experian, and CRIF High Mark are the two main credit bureaus in India. Banks, credit card firms, and other lenders provide their credit information to these bureaus, which then maintains it.

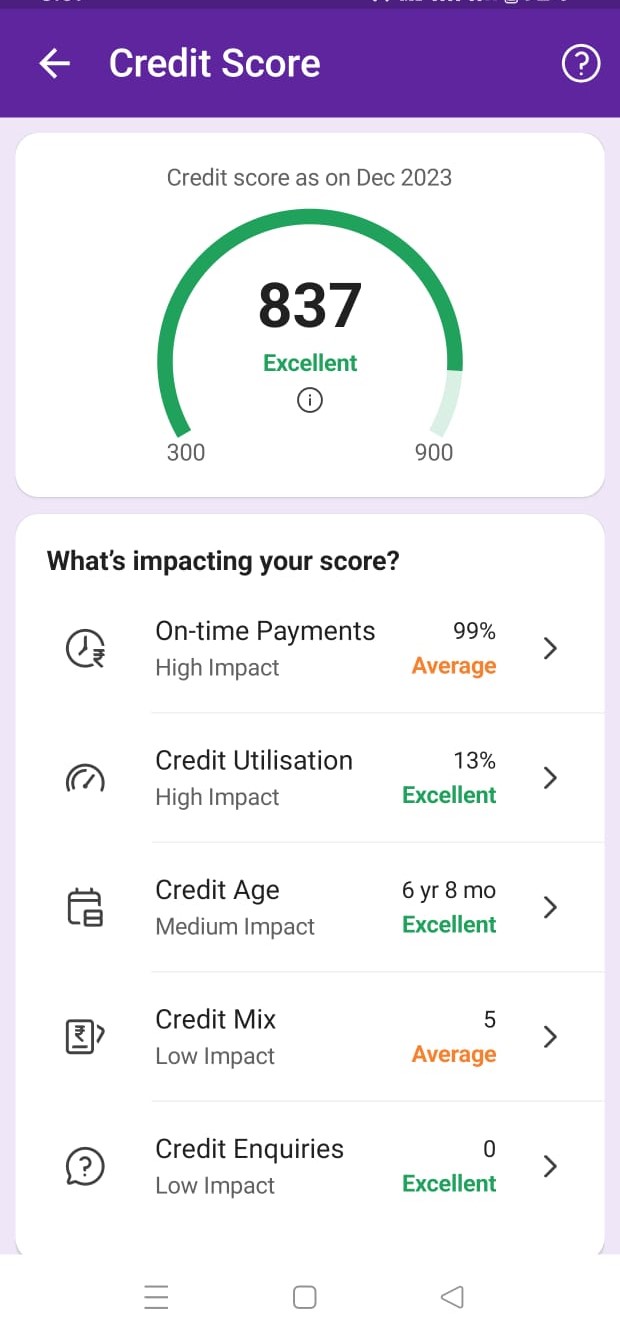

In India, the usual credit score is between 300 and 900. Better creditworthiness is indicated by a higher credit score, which also increases the likelihood of receiving favorable loan or credit terms. A credit score is influenced by the following factors:

How to Calculate Credit Score

- Credit Utilization Ratio: The proportion of credit limit used by the individual. Lower utilization is generally considered favorable.

- Repayment History: Timely payment of credit card bills, loan EMIs (Equated Monthly Installments), and other debts.

- Length of Credit History: The duration for which credit has been utilized. A longer credit history is often seen as positive.

- Credit Mix: A diverse mix of credit types, such as credit cards, loans, and other forms of credit.

- New Credit: Recent applications for credit may have a temporary negative impact.

- Credit Inquiries: The number of times the individual’s credit report has been accessed by lenders in a specified period.

What is Use of Credit Card

One of the main criteria used by lenders to decide whether to approve a loan or credit application is credit score. Based on credit ratings, different lenders may have different requirements and deadlines for granting credit. It’s critical for people to keep a close eye on their credit scores and take appropriate action to raise them when needed. This can involve resolving any inconsistencies in the credit report, managing credit responsibly, and making on-time payments.

How to Check free Credit Score

You can use a number of credit bureaus in India to check your credit score. In India, TransUnion CIBIL, Equifax, Experian, and CRIF High Mark are the main credit bureaus. This is how to look up your credit score.:

- TransUnion CIBIL:

- TransUnion CIBIL: Go to https://www.cibil.com/, the company’s official website.

Open “Get Your CIBIL Score” from the menu.

Provide the necessary financial and personal details on the online form.

Verify your identity by going through the verification procedure.

You will be able to access your credit score after being validated.

- Equifax:

- Visit the Equifax website (https://www.equifax.co.in/), which is the official one.

Locate the area labeled “Get your Equifax Credit Score”.

Fill out the online form with your financial and personal information.

Verify your identity by going through the verification procedure.

You can view your Equifax credit score following a successful verification process.

- Visit the Equifax website (https://www.equifax.co.in/), which is the official one.

- Experian:

- Visit the https://www.experian.in/ website of Experian India.

Find “Get your free credit report” or a comparable link.

Give the details that are required to confirm your identity.

To view your Experian credit score, finish the login process.

- Visit the https://www.experian.in/ website of Experian India.

- CRIF High Mark:

- Go to https://www.crifhighmark.com/, the official CRIF High Mark website.

Find the “Get your credit score” or a comparable link.

Complete the necessary fields so that your identity may be confirmed.

When the authentication process is finished, your CRIF High Mark credit score will be available.

- Go to https://www.crifhighmark.com/, the official CRIF High Mark website.

Your credit score can also be accessed by certain banks and financial organizations via their mobile apps or web banking platforms. To find out if your bank provides this service, check with them.

In order to keep an eye on your credit situation and spot any inconsistencies in your credit report, it is advisable to check your credit score on a frequent basis. Along with the credit score, you can obtain a complete credit report as each credit bureau is allowed to provide you with one free report each year.

Here’s how you can check your credit score by UPI Apps like PayTm,Googlepay,and PHONPE

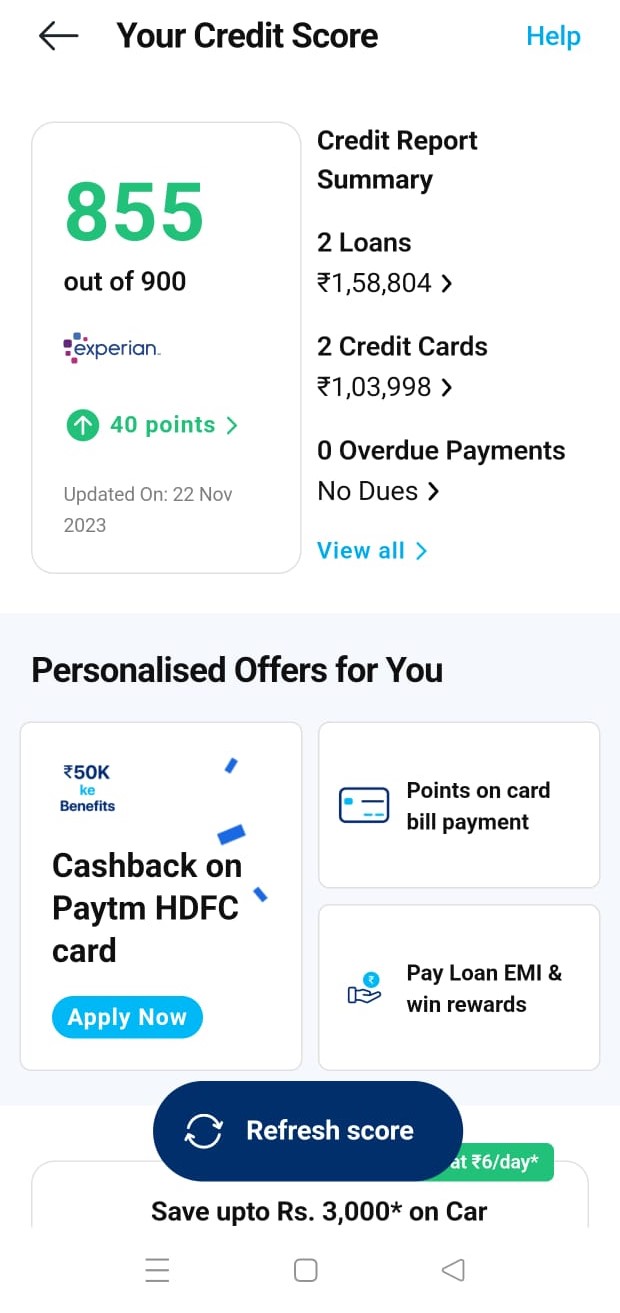

1.Paytm now offers a credit score checking service, follow these steps:

1.Launch the Paytm App: Verify that the Paytm app is installed on your smartphone using the most recent version.

2. Enter Your Account Login: Enter your password and cellphone number to access your Paytm account.

3.Examine the Section on Financial Services: Search for a section on loans, credit scores, or financial services. You can find this under the “Bank” or “Services” section.

4. Credit Score Check: Look into your alternatives for getting a credit report or checking your credit score.

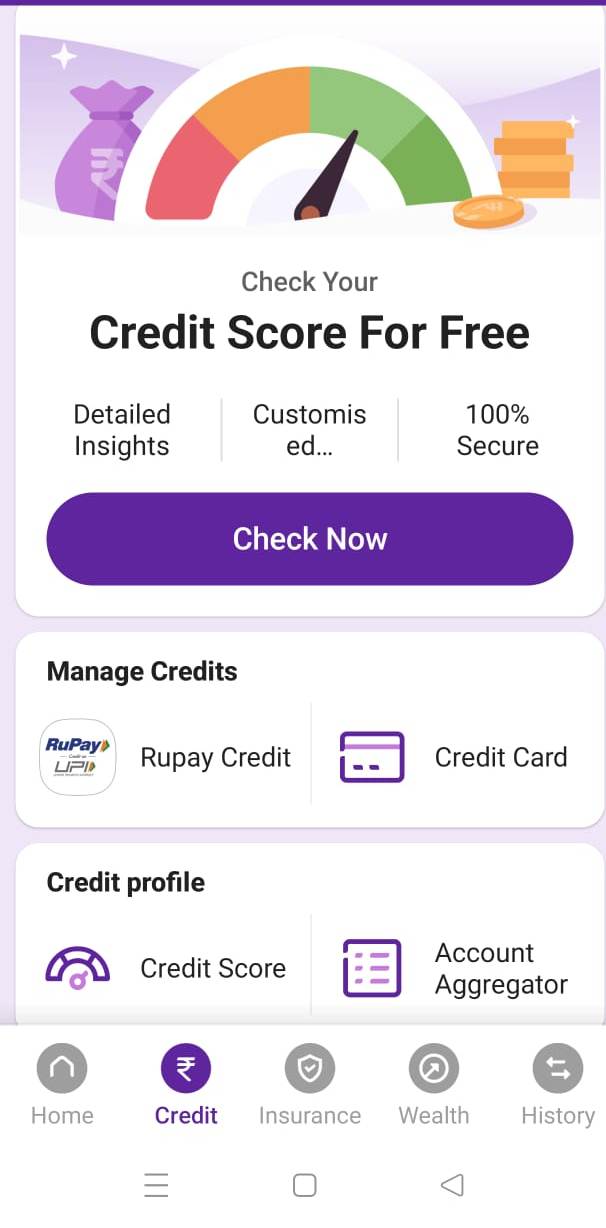

2.Phonepe now offers a credit score checking service, follow these steps:

1.Launch the Ponepe App: Verify that the Paytm app is installed on your smartphone using the most recent version.

2. Enter Your Account Login: Enter your password and cellphone number to access your Paytm account.

3.Examine the Section on Financial Services: Search for a section on loans, credit scores, or financial services. You can find this under the “Bank” or “Services” section.

4. Credit Score Check: Look into your alternatives for getting a credit report or checking your credit score.

3.Googlepay now offers a credit score checking service, follow these steps:

1.Launch the Googlepay App: Verify that the Paytm app is installed on your smartphone using the most recent version.

2. Enter Your Account Login: Enter your password and cellphone number to access your Paytm account.

3.Examine the Section on Financial Services: Search for a section on loans, credit scores, or financial services. You can find this under the “Bank” or “Services” section.

4. Credit Score Check: Look into your alternatives for getting a credit report or checking your credit score.